Winter 2023/24 Recap

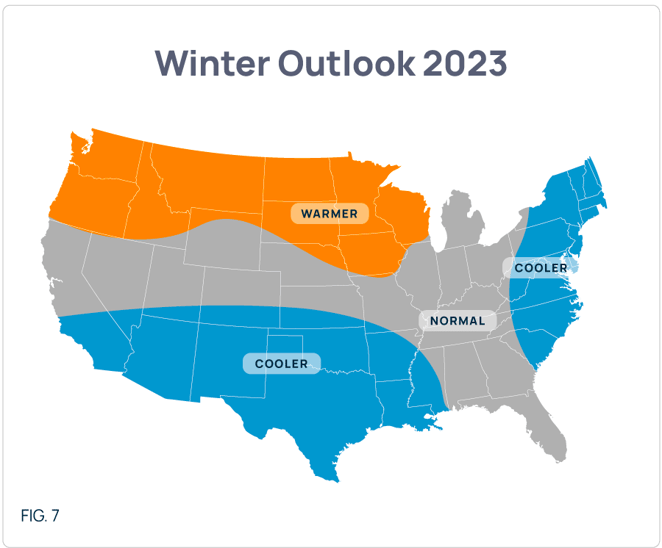

For Winter 2023/24, we forecast a cooler-than-normal Southwest/Texas and East Coast including New England (Fig 7).

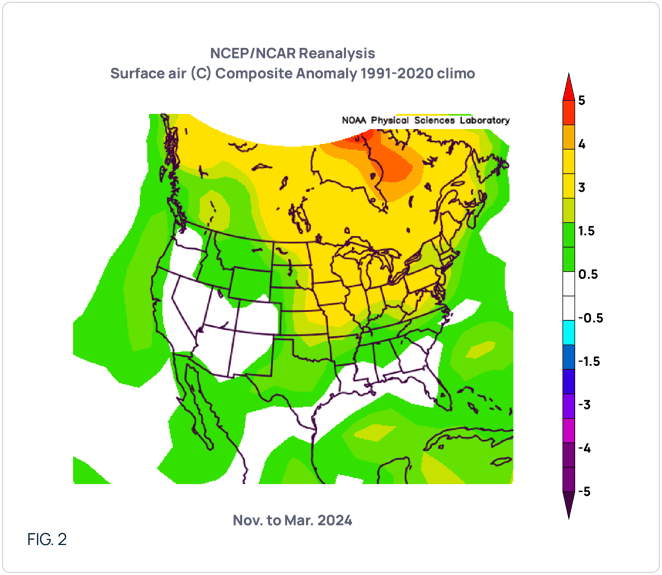

From the NOV-MAR actuals, seen in Fig. 2, it is apparent that our analogs led us astray as the majority of the continental United States actualized warmer-than-normal except for the Intermountain West. While we started off fine as NOV and DEC actualized like we expected, the JAN and FEB cold never materialized like we predicted save for one week in mid-JAN. And that was more anomalous for ERCOT than any other part of the deregulated states. That singular cold event was not enough to overcome the anomalous warmth of the other weeks in the northern tier of the United States. We hope to do better with our Summer 2024 Outlook.

Summer 2024 Outlook

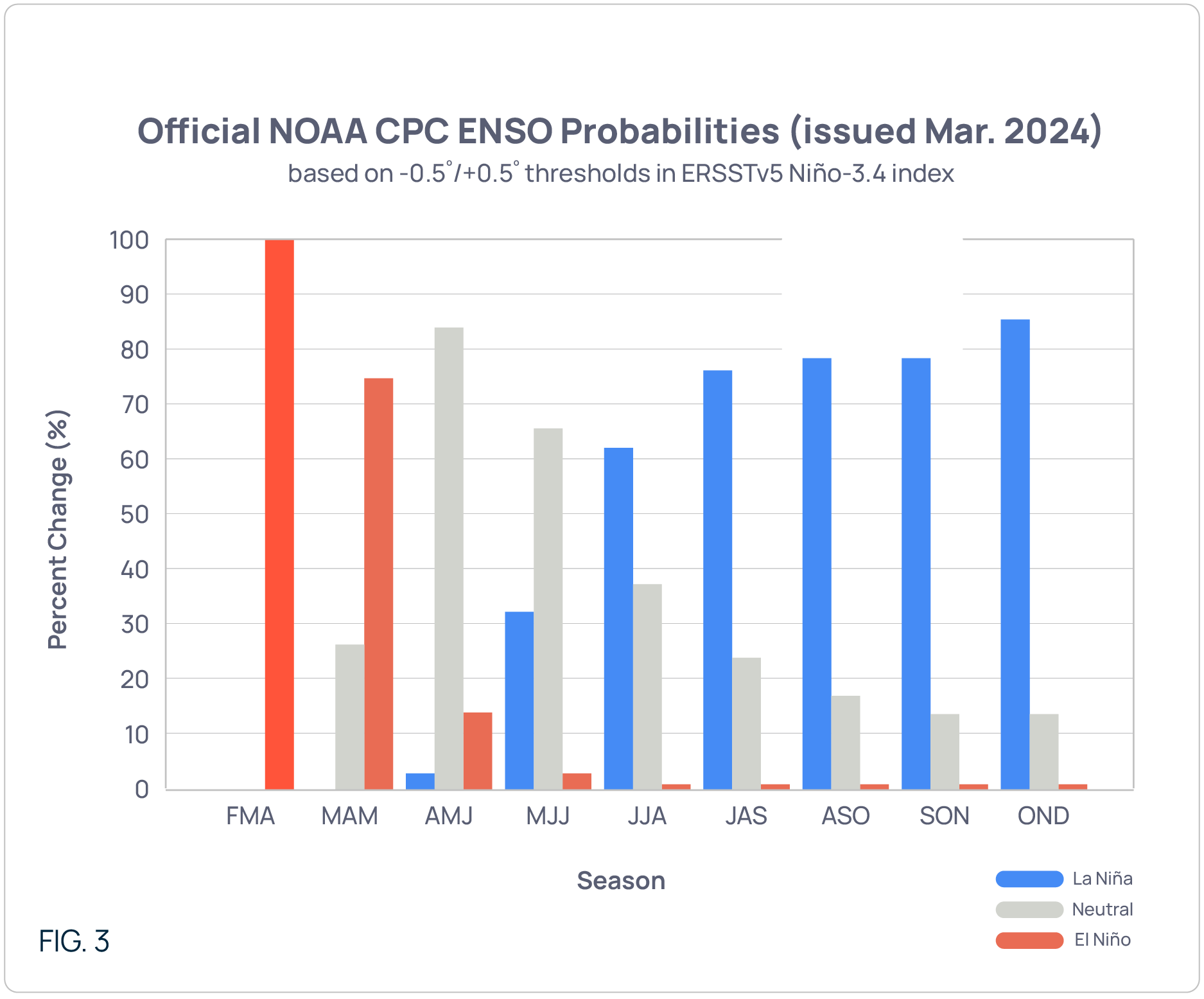

For this summer, climate models are dictating that we deviate from our normal summer methodology. You see, we typically don’t use the upcoming El Nino/La Nina state to drive our summer outlooks as both phenomena are typically a late fall or early winter occurrence and have little to do with summer. Climate models, however, are pointing towards an early La Nina (Fig 3). And we are not talking about one or two outlying models showing this. A full 80%+ of the models are showing this feature developing in the JUL/AUG timeframe. This seems to be consensus, hence our need to deviate from our normal procedure.

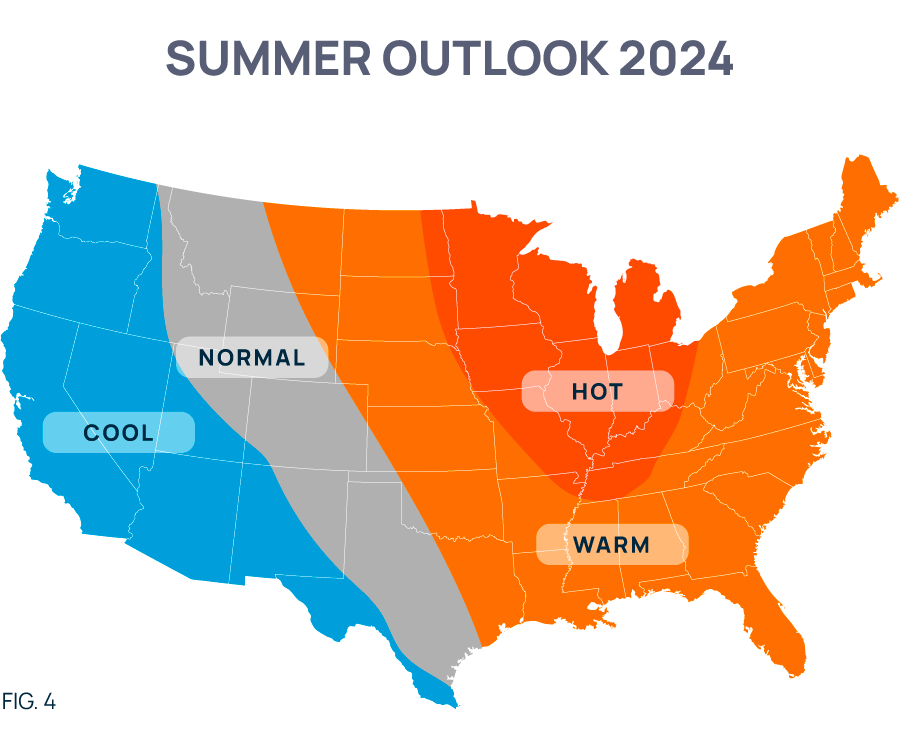

Based on our analogs, we are calling for a MAY-SEP aggregate anomaly map as seen in Fig. 4. With this forecast, the eastern two-thirds of the nation will see at least warm anomalies with the Ohio Valley and Midwest seeing the warmest anomalies. Note that we are calling for generally normal conditions for the majority of ERCOT, with just some minimal warmth in east Texas (including Houston). The outlook for Texas is definitely one of less anomalous heat than was seen in ERCOT during JUN-AUG 2023.

As for timing, we expect the warm anomalies for the eastern two-thirds to begin in May with the strongest anomalies in Aug and SEP. In Texas, we generally don’t see a month where the bulk of the state is under substantial warm anomalies. That doesn’t mean there won’t be any extreme heat for a few days or a week in any particular month(s). We are speaking about “in aggregate”.

Tropical Outlook

A few words about La Ninas and their impact upon hurricane season. First off, La Ninas reduce wind shear in the mid/upper atmosphere. If you remember from previous discussions, wind shear is what can limit both the formation of storms and their subsequent intensity. With the limiting factor of shear potentially being taken out of the equation, expect calls for a very active hurricane season.

As you likely know, a normal tropical season in the Atlantic Basin experiences 13 named storms with 6 becoming hurricanes, and 3 of those becoming major hurricanes (cat 3 or greater). For this summer, because of the prediction of an early La Nina, our tropical forecast is for 18 named storms, 11 to reach at least hurricane status, and for 5 to reach cat 3 or greater. Regarding location, we firmly believe the entire Gulf of Mexico, from Texas to Florida, will be in play. As for the potential impact on NG prices, since the various shale plays have reduced the overall contribution of offshore production to under 4% (with 88% of that amount coming from the Gulf of Mexico), the fundamental impact to our nation’s gas supply should not be materially impacted by short-term rig evacuations and shutdowns in lieu of an approaching storm. HOWEVER, given what we’ve seen in the market over the last 10 years, where funds and other financial players have disconnected the market from fundamentals, a run-up in the price of NG is possible anytime a storm is forecast to impact the production region.

NOTE: POWWR provides this information as a courtesy to enhance the risk management process and are not responsible for the accuracy of this forecast and/or actions taken as a result of this forecast information.

|

|

Mr. Palao specializes in commodity risk management and the science of meteorology/climatology. He serves as one of POWWR’s many subject matter experts. He has 20 years of experience in the energy/utility industry, where he used his skills and knowledge of meteorology and advanced statistics.

From 2000 through 2011, he worked at TXU Energy Trading/Luminant Energy in Dallas where he served in three capacities. Most recently, he served as Capital/Liquidity Manager of the trading portfolio, optimizing the use of capital while still maintaining profitability. Prior to that, he managed the Weather Derivatives trading desk, devising strategies and executing trades for both speculative and hedging purposes. Upon joining TXU, he served as manager of the Quantitative Risk Group, assisting the company in the identification, quantification, and remediation of financial risks inherent in the company’s multi-commodity trading portfolio.

In his first foray into energy/utilities, he was a Marketing Executive with Louisiana Gas Service Company, a local distribution company, where he primarily marketed natural gas technology to commercial and industrial customers. Before that, he served as a Research Scientist under contract to the National Oceanic and Atmospheric Administration (NOAA).

Mr. Palao has an M.B.A. from Tulane University. He also has both an MS and BS in Meteorology from Florida State University. He is a member of the Financial Weather and Climate Risk Management Committee of the American Meteorological Society (AMS).

Share this

You May Also Like

These Related Stories

2023 Summer Outlook Report